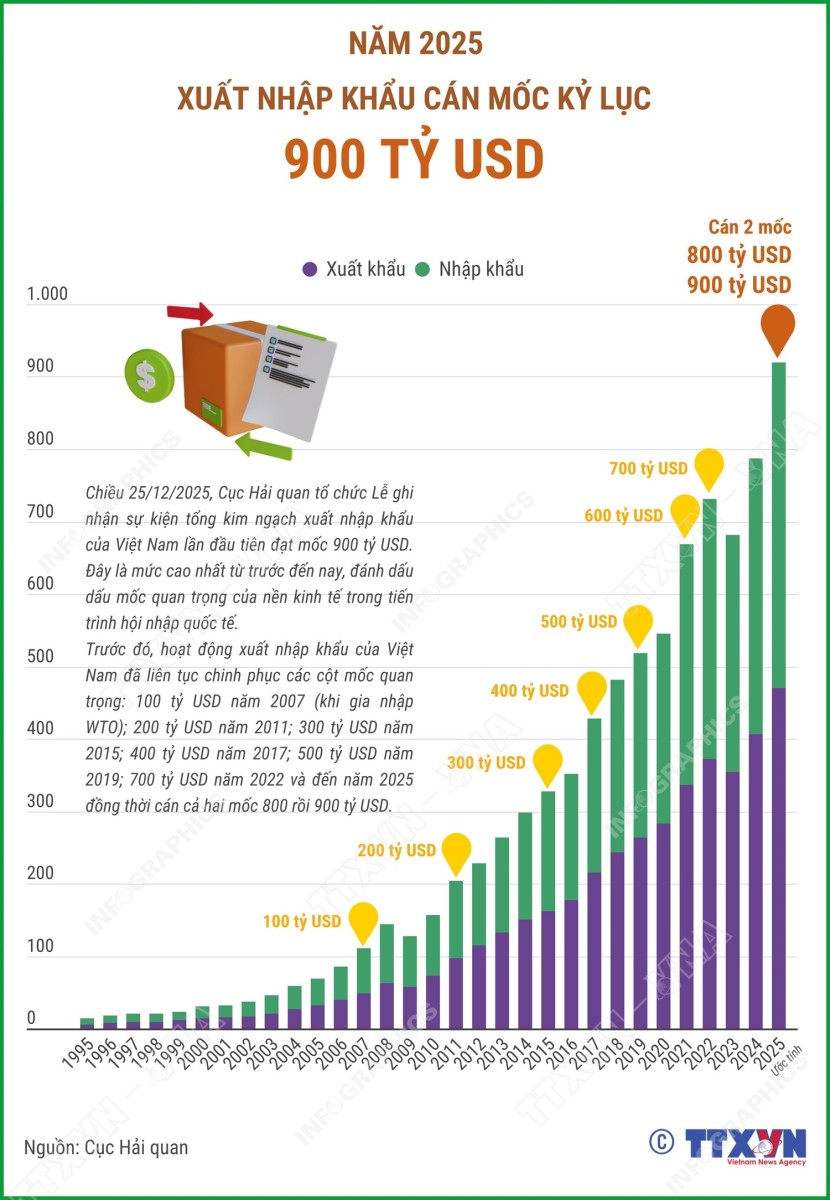

Vietnam’s merchandise trade is set to reach a new milestone in 2025, with total export–import turnover estimated at USD 920 billion, up 16.9% year on year. The country is expected to post a trade surplus of USD 21.18 billion, marking the 10th consecutive year of surplus.

At first glance, the numbers signal strong momentum. Look closer, however, and a more nuanced picture emerges: trade is expanding rapidly in scale, but the quality and sustainability of growth are under growing pressure.

The 2025 record comes despite a fragile global backdrop marked by slower economic growth, geopolitical uncertainty, and rising trade frictions. In that context, Vietnam’s ability to maintain double-digit trade growth underscores its role as a key node in global supply chains and a major beneficiary of free trade agreements and supply-chain reconfiguration.

Yet size alone no longer tells the full story.

Exports in 2025 are estimated at USD 470.59 billion, up 15.9%. Manufacturing continues to dominate, with electronics, machinery, textiles, footwear, and furniture remaining core contributors.

Agriculture, forestry, and fisheries also stand out. Combined exports of seafood and fruit and vegetables are estimated at USD 19.8 billion, up 15.2%, reflecting better processing capacity, quality control, and compliance with international standards.

Still, the underlying structure has not shifted decisively. Foreign-invested enterprises (FDI) continue to account for the bulk of export growth, while domestic firms remain concentrated in lower value-added segments.

Imports are projected to reach USD 449.41 billion, up 18%, growing faster than exports by more than two percentage points. As a result, the trade surplus has narrowed compared with previous years.

This trend reflects higher imports of raw materials, components, and machinery to support production, as well as precautionary stockpiling amid uncertainty over global trade policies. While logical in the short term, it also highlights Vietnam’s continued dependence on imported inputs for export production.

The data over the past three years tell a clear story:

2023: Trade turnover USD 681.3 billion, surplus USD 28.11 billion

2024: Turnover up 15.5%, surplus down to USD 24.94 billion

2025: Turnover up 16.9%, surplus down to USD 21.18 billion

The trade surplus as a share of total turnover has steadily declined from 4.12% in 2023 to 2.3% in 2025. In simple terms, Vietnam is trading more, but retaining less net value from each dollar of trade.

One of the most persistent challenges is the imbalance between FDI and domestic enterprises:

FDI trade turnover in 2025 is estimated at USD 663 billion, up 25%, accounting for around 72% of total trade

Domestic enterprises’ trade activity remains broadly flat year on year

Nearly 99% of overall trade growth comes from the FDI sector

This gap reinforces concerns about limited domestic participation in higher value-added stages of global value chains and raises questions about economic resilience and long-term self-reliance.

The message for the 2026–2030 period is increasingly clear: Vietnam’s trade strategy needs to move beyond scale. Future competitiveness will depend on improving value retention, strengthening domestic enterprises, and aligning trade more closely with industrial upgrading.

The focus is expected to shift toward:

Higher domestic value addition

Deeper integration of local firms into global supply chains

Greater emphasis on green, digital, and knowledge-based growth drivers

Reduced vulnerability to external shocks and policy shifts

Vietnam’s trade performance in 2025 confirms its importance as a manufacturing and trading hub. For investors, the opportunity is no longer just about volume or low-cost production. It increasingly lies in industries, projects, and partnerships that help Vietnam move up the value chain, improve productivity, and capture more value domestically.

The record numbers matter — but how Vietnam earns them will matter even more in the years ahead.

You may want to see: